24+ Paycheck Calculator New Hampshire

See payroll calculation FAQs. Enter an amount for dependentsThe old W4 used to ask for the number of dependents.

Income Calculators Pay Check Salary Wage Time Sheet

Switch to New York salary calculator.

. Web A very small but growing number of states plus the District of Columbia mandate paid leave for an employees own health condition. Semi-monthly is twice per month with 24 payrolls per year. This does not include bonuses.

Web Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator. Check the box if you have more than one job or you and your spouse both have jobs. This calculator will take a gross pay and calculate the net pay which is the employees take-home pay.

Web Gross pay amount is earnings before taxes and deductions are withheld by the employer. While they dont impose a tax on income there is a state tax on. Oregon and Colorado will begin similar programs in 2023.

This will increase withholding. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. How is an employees Social Security and Medicare taxes calculated.

Web Gross pay amount is earnings before taxes and deductions are withheld by the employer. See payroll calculation FAQs below. Web Heres how to answer the new questions.

Semi-monthly is twice per. This calculator will take a gross pay and calculate the net pay which is the employees take-home pay. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Tax year Filing status Taxable income Rate. Web Use PaycheckCitys dual scenario salary paycheck calculator to compare two salary paycheck scenarios and see the difference in taxes and net pay.

Web Heres how to answer the new questions. Nevada South Dakota Texas Washington and Wyoming impose no income tax. Enter an amount for dependentsThe old W4 used to ask for the number of dependents.

California Connecticut Hawaii Massachusetts New Jersey New York Puerto Rico Rhode Island Washington and Washington DC. Web Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator. While they dont impose a tax on income there is a state tax on.

This will increase withholding. Check the box if you have more than one job or you and your spouse both have jobs. Again the percentage chosen is based on the paycheck amount and your W4 answers.

Enter an amount for dependentsThe old W4 used to ask for the number of dependents. The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. The gross pay in the hourly calculator is calculated by multiplying the hours times the rate.

Flexible hourly monthly or annual pay rates bonus or other earning items. See payroll calculation FAQs below. Oregon and Colorado will begin similar programs in 2023.

The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. This will increase withholding. Switch to Tennessee hourly calculator.

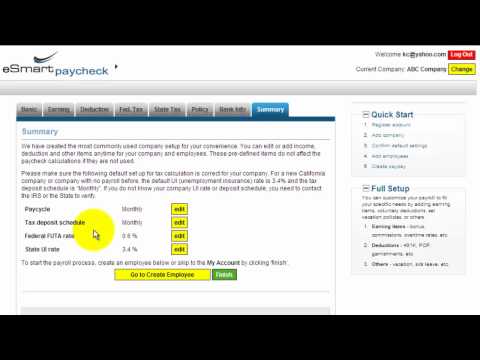

This New York hourly paycheck calculator is perfect for those who are paid on an hourly basis. Check the box if you have more than one job or you and your spouse both have jobs. Web What does eSmart Paychecks FREE Payroll Calculator do.

Web South Court Auditorium Eisenhower Executive Office Building. Web Gross pay amount is earnings before taxes and deductions are withheld by the employer. Web Heres how to answer the new questions.

The lists do not show all contributions to every state ballot measure or each independent expenditure committee. Nevada South Dakota Texas Washington and Wyoming impose no income tax. See payroll calculation FAQs below.

Web This free easy to use payroll calculator will calculate your take home pay. Web Calculate your Nevada net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nevada paycheck calculator. Tennessee and New Hampshire fall into a gray area.

Switch to North Carolina hourly calculator. Web Use PaycheckCitys gross up calculator to determine the take home or net amount based on gross pay. This calculator will take a gross pay and calculate the net pay which is the employees take-home pay.

Web Calculate your Tennessee net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Tennessee paycheck calculator. The new W4 asks for a dollar amount. Employee pays in CT NY.

Employee pays in CT NY. Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Today my administration is announcing new actions to lower the cost of everyday.

Web Heres how to answer the new questions. Check the box if you have more than one job or you and your spouse both have jobs. Web There are six personal income tax brackets that range from 09 to 7.

Web Federal Paycheck Calculator Calculate your take home pay after federal state local taxes. This will increase withholding. Web Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Web The current tax rates are 0 10 12 22 24 32 35 or 37. Tennessee and New Hampshire fall into a gray area. Web Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Web A very small but growing number of states plus the District of Columbia mandate paid leave for an employees own health condition. Supports hourly salary income and multiple pay frequencies. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

The new W4 asks for a dollar amount. Select your state from the list. California Connecticut Hawaii Massachusetts New Jersey New York Puerto Rico Rhode Island Washington and Washington DC.

Web Below are lists of the top 10 contributors to committees that have raised at least 1000000 and are primarily formed to support or oppose a state ballot measure or a candidate for state office in the November 2022 general election. 24 32 35 or 37. The new W4 asks for a dollar amount.

You can add multiple rates. See payroll calculation FAQs below. Use the Arkansas hourly paycheck calculator to see the impact of state personal income taxes on your paycheck.

There are 8 states which dont have income tax and 1 state New Hampshire that has no wage income tax. Computes federal and state tax withholding for paychecks. Again the percentage chosen is based on the paycheck amount and your W4 answers.

You can add multiple rates. Enter an amount for dependentsThe old W4 used to ask for the number of dependents. You can add multiple rates.

The new W4 asks for a dollar amount.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Why Buy A Volvo Vehicle From Us Lovering Volvo Meredith Meredith Nh

41 Salaries At City Of Longview Texas Shared By Employees Glassdoor

Wholesale Lendz Financial

New Hampshire Paycheck Calculator Smartasset

Redundancy Support Resources For London East South East Unionlearn

Agricultural Land In Navi Mumbai Maharashtra 24 Agricultural Farm Land For Sale In Navi Mumbai Maharashtra

Colony Mill Apartments 222 West St Keene Nh Rentcafe

How To Price Your Artwork This Formula Makes It Easy

Heritage At The River Apartments 22a Country Club Dr Manchester Nh Rentcafe

Payroll Tax Calculator Screen

New Hampshire Hourly Paycheck Calculator Gusto

New Hampshire Paycheck Calculator Smartasset

New Hampshire Payroll Tools Tax Rates And Resources Paycheckcity

Paycheck Calculator Take Home Pay Calculator

30 Central St Farmington Nh 03835 Mls 4930106 Redfin

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

The Burke Apartments 1945 Hanahan Road N Charleston Sc Rentcafe